News Post

Prime factors around global biofuel growth

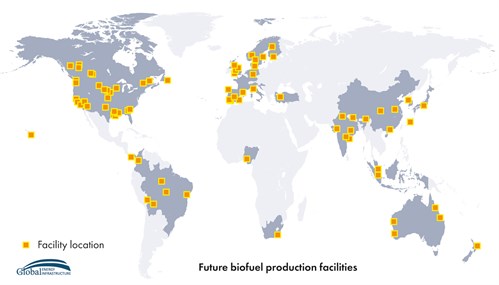

Global biofuel consumption is expected to rise by 20% from 2022-27, according to the IEA in 2023. Several reasons are expected to be responsible for this increase, including regional demand, climate change and energy security concerns.

The US, Canada, Brazil, Indonesia and India are expected to comprise 80% of the global expansion of biofuel demand. While the US is the clear leader in biofuel facility development, with upcoming projects such as California’s 800m gal/y Rodeo Renewed project, the country appears to not be building any new oil refineries domestically for the foreseeable future.

Renewable diesel and sustainable aviation fuel (SAF) are expected to see their growth in advanced economies such as the US and Canada, while ethanol and biodiesel growth is expected to be part of the picture for emerging economies such as Brazil and Indonesia. Regarding the growth in renewable diesel and SAF, the policies in place that are designed to reduce greenhouse gas (GHG) emissions are primary drivers, since renewable diesel and SAF can have lower GHG emissions, have the ability to be blended and the feedstock can come from basically inexhaustible waste products such as used cooking oil and other residues. The US is also benefiting from the Inflation Reduction Act, which was designed to make cleaner energy investments more economical while allowing for faster returns on biofuel developments.

Biodiesel growth in emerging economies will also benefit from biofuel-friendly government policies, but what’s different there is the advantage of using indigenous resources and plentiful available land to produce the feedstock necessary by way of soybean oil and animal fats. Even as the basic feedstock needs remain similar, the approaches made by these countries vary due to the resources on hand and the support given by the respective governments, such as India’s very recent announcement of its global biofuel alliance with Brazil at the G20 Summit to boost cleaner fuels.

Emerging economies also focused on energy security as a prime driver for biofuel growth. Even before the Russia-Ukraine conflict brought a level of instability to the supply chain, energy security was deemed a goal by many countries as a means of lower imports and self-reliance while also utilising the resources already on hand. Driven by this need, nearly two-thirds of biofuel demand growth by the end of 2024 is expected to come from India, Brazil and Indonesia.

SAF is approximately 0.1% of the jet fuel being consumed globally, which is somewhat behind the pace of renewable diesel and biodiesel integration into daily consumer use. Although SAF blended with traditional jet fuel can be a drop in fuel, it’s the cost of SAF that continues to be a complication. Boeing CEO Dave Calhoun recently said regarding SAF’s cost equivalency with traditional kerosene jet fuel that “I do not think that will ever happen.” So, although SAF is deemed as an essential way to reduce emissions, high costs remain a barrier for this fuel’s growth for now.

For subscriptions or a demo:

Sam Hassaniyeh

Subscription Executive

Phone: +44 203 4092242

For questions or to give feedback:

Thad Pittman

Senior Researcher

Phone: +1 (713) 525-4605

Download our brochure today!

Project News